- Inflation is expected to decline in 2023 but is unlikely to reach the level targeted by central banks

- The U.S. Fed, may be willing to tolerate inflation moderately above target, as the inflation regime shifts, and growth suffers

- Recent financial sector problems may push to Fed to take a more cautious stance on further tightening

Central bankers have leaned heavily into their hawkish narrative as the global economy proved to be resilient to rising higher interest rates. Market expectations for how high policy rates would go or how quickly inflation would fall dominated market views.

Most recently, the toll of the aggressive rate hiking cycle has started to manifest in pockets of the U.S. banking sector (see our recent coverage here). The actions by the U.S. Federal Reserve (Fed) and the U.S. Treasury to stabilise markets may be at odds with a continuation of higher interest rates.

The persistence of inflation is likely the determining factor in whether central bankers, specifically the Fed, can really call an early end to the rate hiking cycle.

Our view is that inflation pressures are easing, and the pace of inflation will continue to decline throughout 2023 in the U.S. and in other developed markets. The debate and uncertainty in market at present is not whether the rate of inflation will come down, but how long this may take and what the likely endpoint will be. Central banks had appeared determined in their resolve to reach their 2% inflation targets, but this may not be the case.

When inflation was too low in the U.S., the Fed adopted average inflation targeting, or a willingness to tolerate a period of above target inflation to offset the extended period of below target inflation. This was quickly dropped as inflation rates surged to multi-decade highs, but the Fed’s tolerance for inflation that is somewhat above their target may not have.

The assumption is that central banks should be able to manipulate the rate of inflation by impacting the level of aggregate demand. In the long run this is true, but there are forces that may push them off course. Most recently these forces were linked to the supply side of the economy such as the disruptions to supply chains and the availability of labour.

The supply side issues are fading and we anticipate U.S. inflation falling throughout 2023. But there are structural reasons why inflation may be higher in the coming decade than in the prior one. These include the slower pace of globalisation, policy changes associated with ESG goals and climate change commitments, and the distribution of incomes.

As such, the Fed may be willing to accept inflation that resides above its 2% target. A level of inflation that was moderately above target could mean the Fed would face periods of very low inflation, re-engage a zero interest rates policy or use their balance sheet and quantitative easing to the same extent in the future.

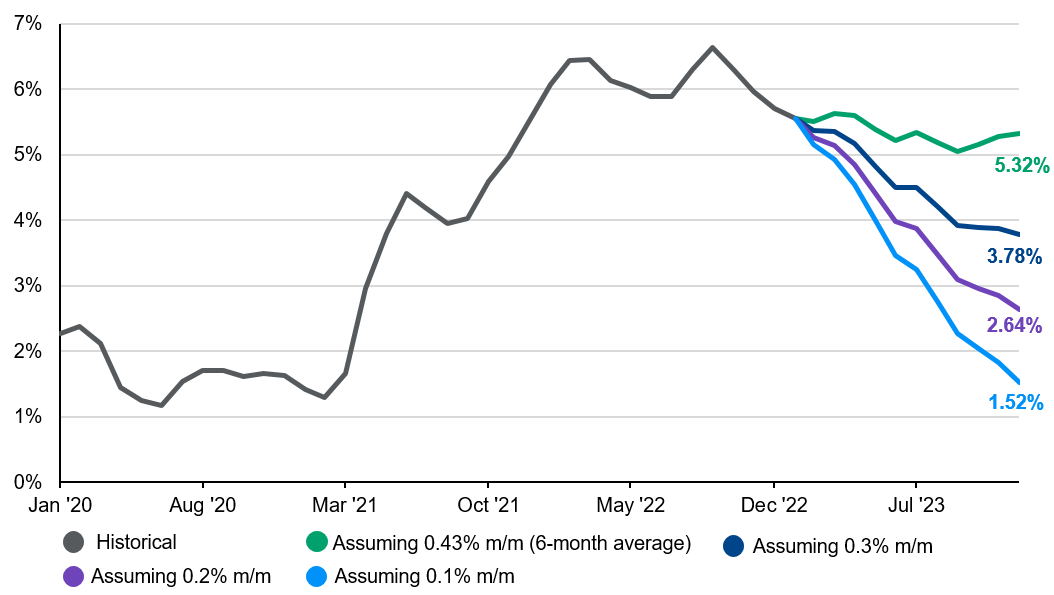

Obtaining the 2% target in 2023 seems unlikely. Our view is that inflation in the U.S. drops to 4% by mid-year and then more slowly towards 2% in the following quarters. The Fed’s most recent economic projections from December had core PCE inflation falling close to 2% by 2025.

Exhibit 1: Potential pathways for inflation

Core CPI, seasonally adjusted, forecasts post-January 2023

Source: Bureau of Economic Analysis, FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 14/03/23.

While the February labour data showed another 311,000 jobs being added in the U.S. the detail was modest given the rise in the unemployment rate and further decline in wage growth. The moderation in the labour market when combined with the financial stability concerns may result in a Fed that is less brazen when it comes the to path of higher rates, but we expect further tightening to come.

However, as inflation trends lower, the Fed’s stance on inflation may soften as the focus shifts from inflation to how much the economy has deteriorated, and potential economic pain being inflicted on households.

Investment implications

For investors this means the relenting on the bias associated with the low-rate environment of the prior decade and that we may be in for a longer-term period of higher highs and higher lows when it comes to the yield on government bonds.

The higher yield on short-dated government bonds has meant investors can pick up carry while limiting exposure to higher rates given the lower duration.

But the sharp repricing in core government bonds along with rising recession risks, there is a case to shifting further along the curve to longer-dated bonds. Risks to growth may mean that 10-year Treasury yields do not retest 2022 highs and offer more scope to decline should the economic outlook deteriorate meaningfully.

Additionally, the positive stock-bond correlation that plagued investors portfolio’s in 2022 was induced by high and rising rates of inflation. The shift in drivers of yields from inflation risks to the growth outlook should increase the diversification benefits of holding longer dated bonds and a negative correlation to equities.