We see the backdrop for EM assets turning more positive as EM rates peak, DM central banks pause, the U.S. dollar weakens and China reopens. By contrast, the damage of higher rates has yet to fully materialize in DM. We prefer selected EM equities and bonds over DM peers as a result.

Relative retreat

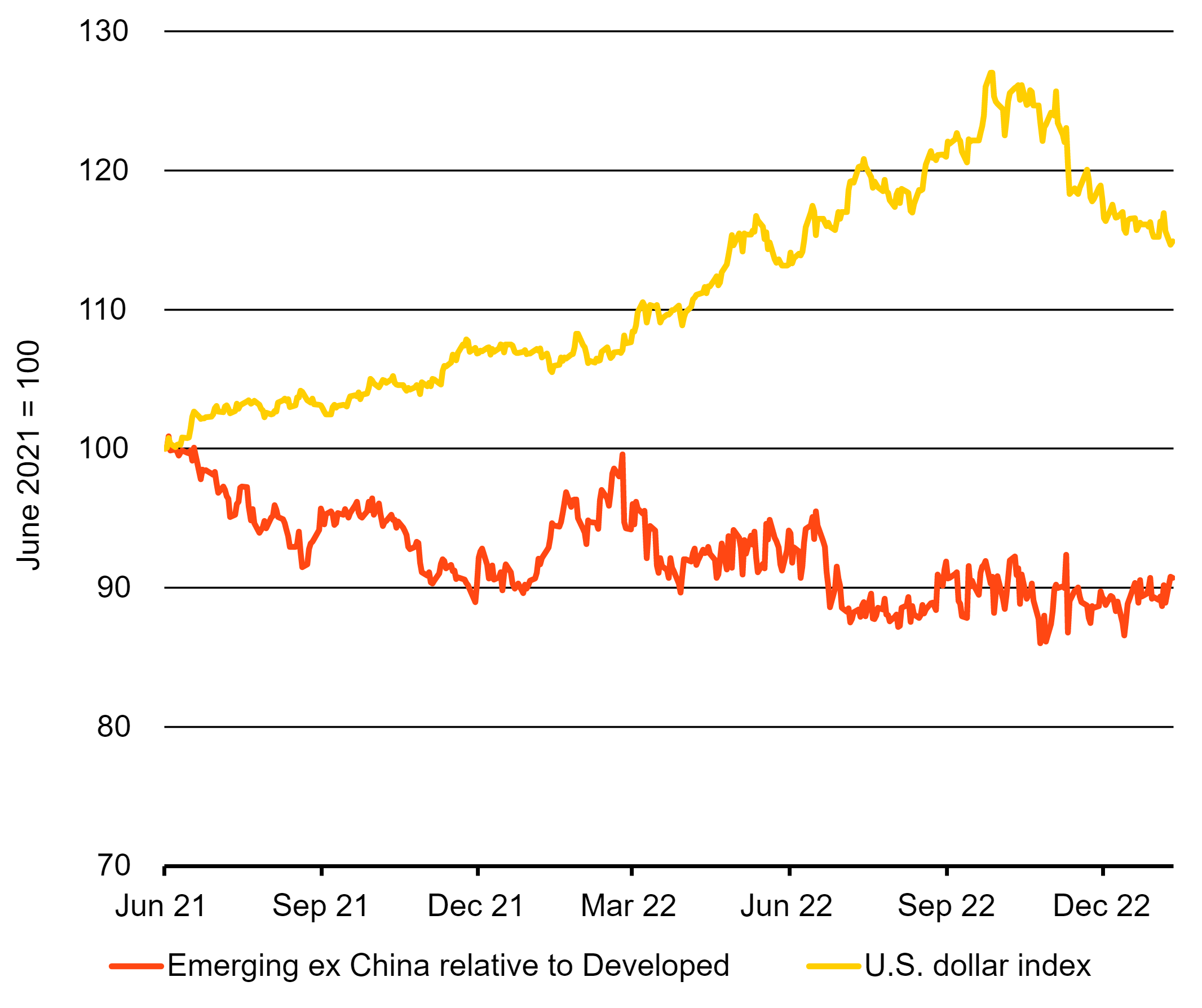

Emerging equity relative performance and the U.S. dollar, 2021-2023

Sources: BlackRock Investment Institute, with data from Refinitiv Datastream, January 2023. Note: The chart shows MSCI Emerging Markets Index total return index divided by MSCI World (orange) and the U.S. dollar DXY index (yellow) rebased to 100 at the start of June 2021.

EM economies proved resilient to what should have been a big hit from tightening global financial conditions as the Fed embarked on the fastest hiking cycle since the 1980s. We see several reasons why. EM external balances have improved, central banks were ahead of DM in policy tightening, and higher commodity prices limited the fallout. Yet EM equities have underperformed DM peers – down nearly 20% since mid-2021 (orange line), when many EM central banks began to tighten policy. This slump might be warranted if there were some systemic risk for EM looming – but we don’t see that now. We think the long EM stock slide and recent rally show a lot of economic damage is now in the price as the EM backdrop turns more supportive. The U.S. dollar’s retreat (yellow line) and China’s reopening rally also helped EM assets in recent months.

We think the backdrop will turn more positive for EM, building on recent resilience. EM generally has higher levels of currency reserves, smaller current account deficits, improved external balances and better debt maturity mixes than they did in past DM tightening cycles that sparked volatility. The weaker links among EM are small and not a broader threat, in our view. We think this all helped EM avoid a “taper tantrum”-type investor flight when global financial conditions tightened. In fact, investors favoured EM: our data shows inflows into EM equity exchange-traded funds hit a record in 2022.

Policy picture

We also see slowing tightening cycles in EM. Some EM central banks were as much as a year ahead of DM in hiking rates to combat inflation. We expect some divergence - inflation expectations in Brazil are declining, but the energy crunch in Europe is likely to keep inflation pressures higher in the EM countries of the continent. We see DM central banks pausing as the economic damage of their tightening becomes clearer – and as inflation cools from highs but still stays above pre-Covid levels. A pause in the Fed’s rate hikes would likely help spur a further retreat in the U.S. dollar. The risk? Markets have been pricing in Fed rate cuts later this year – something we don’t expect to happen given persistent inflation.

China boost

China’s reopening also brightens the view on EM as domestic demand restarts. Chinese assets represent a sizable share of EM indexes, so we see overall EM as a beneficiary of the reopening. Rising Chinese demand is likely to benefit other EM exporters with strong ties to China as growth rebounds, too. We estimate China’s economic growth will be above 6% in 2023, but it will be tempered by falling exports as goods demand cools with spending shifts in developed economies away from goods and toward services. That makes consumer spending and business investment even more critical in gauging how strong China’s recovery can be. We prefer Chinese assets to DM peers as well. Structural risks including an aging population and geopolitical tensions with the U.S. persist, but a strong rally in risk assets since October is becoming harder for some tactical investors to ignore.

Our bottom line

We see a more positive EM backdrop as DM central banks pause, the dollar weakens and China reopens. We take a selective approach across EM – with a wide range of factors at play, from external balances to idiosyncratic sovereign risk. We prefer EM over DM stocks – we think more damage is in the price from earlier hiking cycles. We’re neutral EM debt due to higher commodity prices and prefer it over long-term DM government bonds. Long-term DM yields don’t reflect the term premium, or compensation for risk, we think investors will demand in this regime of higher macro volatility.

Market backdrop

Global stocks added to gains this month, with European shares leading the way. U.S. Treasury yields retreated further, while the U.S. dollar index hit seven-month lows. The market is still pricing in Fed rate cuts later this year as inflation cools, as reflected in last week’s CPI. We think inflation will come down a lot this year – but not enough for the Fed to cut rates. We see the Fed pausing rate hikes once the damage from its policy overtightening is clear and then staying on hold.

China GDP is likely to slow, reflecting the disruptions from the rapid spread of Covid-19, but we see the reopening spurring a strong rebound this year. The Bank of Japan meets and may further widen its yield curve control for 10-year yields – or abandon it altogether. Japan’s CPI data for December may provide the impetus for any such move.