This informs our long-term investment views. Private markets are long term by design – they’re also complex and not suitable for all investors. Public market selloffs have cut the relative appeal of many private assets, but we see value in infrastructure thanks to a huge investment wave powered by the energy crunch and digitalisation.

Investment gap

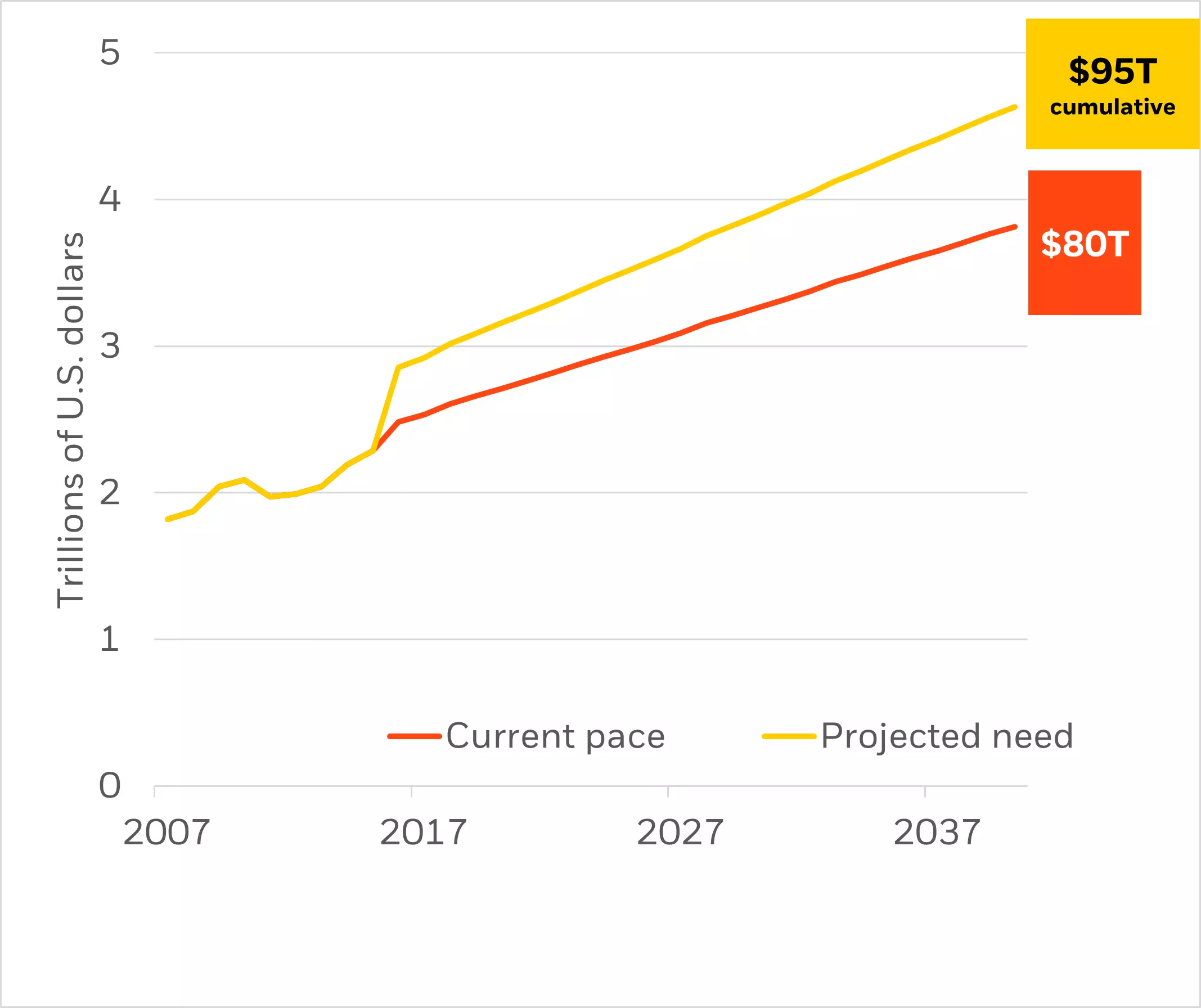

Infrastructure investment, 2007-2040

Sources: BlackRock Investment Institute and World Bank, 2017. Notes: The chart shows estimated infrastructure investment for 50 countries through 2040. The yellow line shows investment needed annually. The orange line shows investment trends assuming countries invest in line with current trends. The cumulative total of $95 trillion is for investment needed vs. $80 trillion in current trends. Forward-looking estimates may not come to pass.

What makes infrastructure special? For one, elements of it can be seen all around. From roads to airports and energy infrastructure, these assets are essential to industry and households alike. Future needs also appear to be rising at a rapid pace. Infrastructure has the potential to benefit from increased demand for capital over the long term. An estimated $95 trillion of cumulative investment could be needed to meet global infrastructure demand over the next two decades, World Bank data show (see the yellow line in the chart). That’s compared to the estimated current pace of around $80 trillion (red line), implying a total investment gap of about $15 trillion. We also find infrastructure valuations have been steadier than other private markets like real estate and private equity – they haven’t increased as much in the falling rate environment of the past few decades.

Structural trends could also support infrastructure. We find that the net-zero transition isn’t fully priced by markets across many asset classes. We think infrastructure has potential to capture the expected shift to sustainable assets. In the U.S., the Inflation Reduction Act alone earmarks nearly $400 billion of investment and incentives in sustainable infrastructure and supply chains – and the potential to pull in private investment goes well beyond the headline figures. That means there could be opportunity for private investors to get at favourable financing costs. Other trends like digitalisation and decentralisation signal potential for greater demand. More infrastructure would be needed to allow for the future of work. As location becomes less important, holdings would need to diversify for resilience and efficiency.

Infrastructure focus

We believe that infrastructure stands out with the potential to diversify returns and help provide stable long-term cashflows. Why? Infrastructure earnings are less tied to economic cycles than corporate assets. Long-term contracts are common. Contracts can span decades – a significant advantage in a volatile environment, in our view. Infrastructure assets also have the potential to hedge some of the effects of inflation. Most power and utility assets link their costs and prices to inflation through regulations, concession agreements or contracts. That allows them to pass higher expenses through to end users. We see risks. The new regime of increased macro and market volatility hangs over all markets, including private markets – they’re not immune to rising interest rates. Key production constraints like labour could take longer to normalize, and interest rates could remain higher than historical norms. Both would raise costs. More specifically to infrastructure, governments could also impose artificial price caps amid political pressure.

Our bottom line

What does this mean for investments? We believe private assets – while not appropriate for all investors – still have a sizeable role to play in strategic portfolios thanks to their potential diversification properties and returns. We’re underweight private markets as a whole but from a starting allocation that is much larger than what we see in institutional portfolios. As these long-term commitments reprice more, we see potential opportunity in private infrastructure given rising investment and the potential for resilient cash flow and a degree of inflation protection. Asset selection is vital, in our view, given the high dispersion of performance even within the infrastructure sector. Investment horizon is key, too. Investing takes time in private markets – funds can take up to five years to invest and over a decade to realize performance. Private markets are complex and may not be suitable for all investors.

Market backdrop

U.S. stocks slumped back near their lows of the year and short-term Treasury yields pushed near 15-year highs. September U.S. payrolls on Friday showed job gains in line with consensus with no improvement in the supply of labour. We don’t think this changes the Federal Reserve’s singular focus on inflation since it hasn’t acknowledged the policy trade-off. This underscores why we think the Fed will trigger a recession – and we don’t think hard-hit risk assets reflect the likely damage.

The U.S. CPI this week will be key for gauging the size of coming Fed rate hikes after the September jobs data reinforced expectations of more large hikes ahead. We think the Fed’s singular focus on bringing down inflation will trigger a recession – and we only see it stopping once the damage becomes clear. We should also see China’s credit data.